If you've been trying and trying to get a Late Payment removed but just can't seem to make it happen, don'tt worry, you've come to the right place.

This is a guide to the most underrated and MOST EFFECTIVE Late Payment Removal method available: The CEO Method.

Let's face it...the traditional methods to remove Late Payments off your Credit Reports just aren't as effective as they used to be.

When searching for the best Late Payment Dispute Methods on the internet you will get a multitude of mixed up options, like the Goodwill Letter Method or the traditional Late Payment Dispute Method. Both of these methods tend to be ineffective and yet still widely used by Consumers and Credit Repair companies all over the United States.

When it comes to removing Late Payments off your Credit Report, we really only have one shot, so we'd better get it right the first time...

Let's dive into the details!

What Is the CEO Method?

The CEO Method is a simple and effective method of disputing Late Payments on your Credit Reports. Instead of using the Traditional Dispute Letter Method where you draft a Dispute and cross your fingers that the Account is Removed off your Credit Report. No, no. This Method can instead provide you a FASTER and MORE EFFECTIVE response to your Dispute and it's usually within a couple of days!

Why This Method Is So Effective

If you were appointed as CEO to run a large firm and an angry client called you about your product and they told you how upset they were, what would you do?

Well, most CEOs would want to take care of the client because they never want to be labeled as careless or unsympathetic in regards to their customers. They are usually willing to do whatever it takes to make the client happy. I mean, when you think about it, without Clients, there is no CEO.

This method allows you to go straight to the "Decision Maker" and bypass all of the gatekeepers within the company. You're able to directly explain your situation and convince the CEO to help you by ensuring the removal of the Late Payment. This method is a Credit Repair Hack that not many people use. The challenge of it is getting the CEO's email address and constructing the best email to effectively get what you want...

Traditional Dispute Methods

Before we cover how to use The CEO Method, it's VITAL that you understand the other most commonly used Dispute Techniques by other Consumers and Credit Repair companies.

To ensure The CEO Method is effective, you will want to know WHY the Traditional Methods are significantly less successful, in order to avoid adding certain phrases and verbiage that would hurt your chances of getting the Late Payments removed.

There are three commonly used Methods:

- The Goodwill Method

- Factual Dispute Method

- "Wasn't Late" Dispute Method

Let's go through each of them...

The Goodwill Method:

This method simply requests that the Creditor remove a Late Payment in "Good Faith" because you either...

- Went through a hardship and you want them to understand it was out of your control.

- You simply forgot to make the payment. Truly an accident.

With this Method, your approach is to write a paragraph or statement explaining what happened and request that they do you a HUGE favor and remove the Late Payment off your Credit Report with the understanding you will never let this happen ever again.

Back in the early 2000's this Method actually used to be effective, because you could easily send in a Direct Dispute to the Creditor with your statement and most Creditors would delete the Late Payment as a favor. As laws and regulations have drastically changed, so has the leniency of the Creditors and their ability to LEGALLY remove Late Payments...

The CEO Method takes this very same Method and simply changes the approach and delivery to create a much FASTER and EFFECTIVE Result.

Factual Dispute Method:

Outside of the CEO Method, The Factual Dispute Method is one of my favorite Methods when used correctly and strategically. When it comes to getting items removed through Disputes, I have always said you do not need to know ALL the Credit Laws in order to achieve successful Credit Repair, but you DO need to know which Laws will help you get the end result you are looking for.

Most people who try to repair Credit on their own don'tt understand HOW they plan on getting the items Removed and MOST will use a Template Based Letter that they find "somewhere" online.

With Factual Disputing, you are using the FACTS of the Law to Dispute your Credit. I wrote an ENTIRE article on Factual Disputing- I definitely recommend you check it out to learn more!

My last piece of advice is to do your research and devise a game plan on what you're going to do BEFORE just mailing out a Dispute Letter. You can actually reduce the likelihood of getting an item Removed if you send the wrong Dispute initially.

"Wasn't Late" Dispute Method:

This method is by far the WORST type of Dispute you can use. As you may have noticed, there is a strikethrough the word "Method" in the header. That is because this is NOT an effective method, this is a sure way to wreck your chance of getting the outcome you're looking for when Disputing.

But why is this a big NO NO??

Unfortunately, millions of people have used (and continue to use) this particular Dispute Process because it's LAZY. If you're using this Process, it says you're NOT taking a serious approach when it comes to fixing your Credit Report. This is also one of the many reasons you'll find people online saying removing Late Payments is impossible.

Let me explain...

The Ultimate Goal of disputing your Late Payments is to have the Creditor provide proof that your Late Payment is accurate.

When you Dispute using this process, you are essentially saying "I was never late, please remove this Late Payment."

Creditors have strict reporting Laws they have to follow in order to avoid large penalties AND they have so many ways to prove that you were late. It becomes easy for them to provide simple proof that you were, in fact, late. Not only does this process hinder your chances of getting a Late Payment removed, once they deem you were late, it will STAY on record and make it nearly impossible to EVER remove the Late Payments off your Credit Report, even if DO you change Methods.

It's assumed you were "Lying" in the eyes of the Creditors and they will normally refuse to investigate any future Disputes on the Late Payments in the future. When I say this method can make your problems worse, yeah, this is exactly what I mean.

Stay away from this "method" at ALL costs.

The CEO Method Explained...

Now that you understand the three most commonly used Methods when disputing Late Payments, I want to tell you about a 4th and VIRTUALLY UNKNOWN Dispute Method that can provide you BETTER results when disputing Late Payments.

This method is not widely used because it relies on Email as the Method of Delivery. Most people who Dispute their Credit Reports prefer the traditional, ol' US Mail method.

Benefits of The CEO Method

- Much FASTER Results (usually within 2-7 days)

- Go straight to the Source - Method which allows you to contact the ultimate Decision Maker

- Easier Method than Traditional Mailed Disputes

- Underrated Method (that no one talks about)

- Highest Efficiency rate when it comes to Removing Late Payments

- Costs nothing (no paying for Certified Mail)

- Better papertrail of Proof that's easy for YOU to access

Understanding Your Dispute Approach

When using this method, you have ONE chance and ONLY ONE CHANCE to get your concern fully resolved. Using the wrong approach or coming off too demanding in your email can make the Creditor less willing to help.

You have to examine your situation and decide which approach works best for you. There are two recommended approaches you can use depending on the account you're disputing...

#1 Proof Dispute

This Method just means you have Proof that you were in fact NOT Late and you will be focusing on explaining and providing this Proof in your email. This Method will be the MOST EFFECTIVE because you are disputing using actual facts and backing them up.

When it comes to clerical errors by a Creditor, your chances of the Creditor responding with an immediate solution is the highest with a Proof Dispute.

Here's An Example of what your dispute paragraph will look like...

CEO,

My Name is <Your Name> and I am a customer of <Company Name> and have been for over <Total Years account has been open.> I recently noticed your company has been reporting me late which is incorrect. <Reason as to why their reporting is NOT valid> I also have proof that I can send that demonstrates I was truly not late (didn't want to include the attachment in this email as I worried about it being flagged for spam). I am requesting the reporting status be corrected on my credit report and the late payment be removed. My credit rating and standing has been something that I have worked hard to build and maintain and the current events have caused my credit to go into a negative standing which has been really difficult for my family and me. I appreciate you taking the time to read this email and correct the error.

#2 Forgiveness Dispute

I know, I know...I keep talking about how ineffective this Method is, but that's when you send it through the US Mail. It's actually about HOW you use a Forgiveness Dispute that makes the most difference. It's MUCH more effective when you go DIRECT to the CEO to get your concerns resolved. Except this time, it will be via email.

With this Method, you explain your situation and why you were late, and hope that the CEO has empathy for your situation. You'll have to appeal to their generous side and ask, as a one time favor, that they remove the Late Payment.

CEO's get emails of Clients' concerns all the time, so for you to catch their attention, it will have to be a personal and emotional appeal. Your letter needs to stand out and be original.

Here's an example of what your Dispute paragraph will look like...

CEO,My Name is <Your Name> and I am a customer of <Company Name> and have been for over <Total Years account has been open.> I recently noticed your company has been reporting me late which has left me devastated <Why this hurts you emotionally> and because of this I am seeing if I can request one really big favor from you. <How this late payment will affect you now and down the road> and I wanted to see if you could remove the late payment off my credit report. <Reassurance statement telling them why you won't be late anymore.> My credit rating and standing is something that I have worked hard to build and maintain, and the current events have caused my credit to go into a negative standing which has been overwhelmingly difficult for my family and me. I truly appreciate you taking the time away from your busy day to read this and I really hope you're able to help me, this will mean more to me than you know.

The Forgiveness Dispute can take time to write, and I also recommend you have someone close to you proofread it to make sure it tugs on their emotions in the way that you intended. Ask if they were the CEO, would they feel enticed enough to remove the Late Payment off your Credit Reports.

Obtaining the CEO's Email Address

Although this article is called the CEO Method, you won't always be able to locate the CEO's email address and may have to revert to finding the next-in-line position, such as a President or Vice President.

Actually, the more emails you can find the better, because you will want this email to be forwarded to the correct person in the event there was a recent position change within the company.

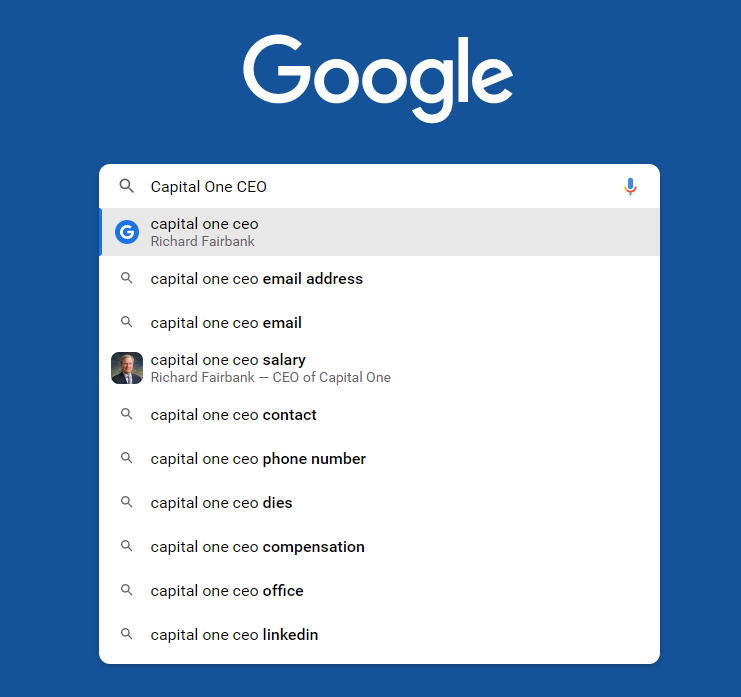

Step #1- Find out the CEO / President / VP / Management

The best way to do this is simply do a Google Search for this information. In the Google search bar, type in the Company Name followed by "CEO": For this Example, I'll use Capital One:

If there is no CEO, simply try another job title, like "President" or "Vice President".

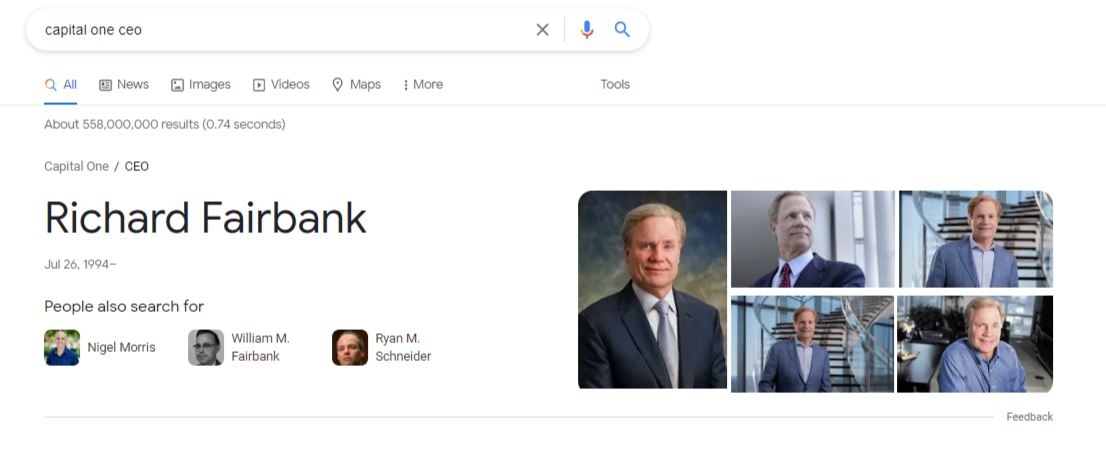

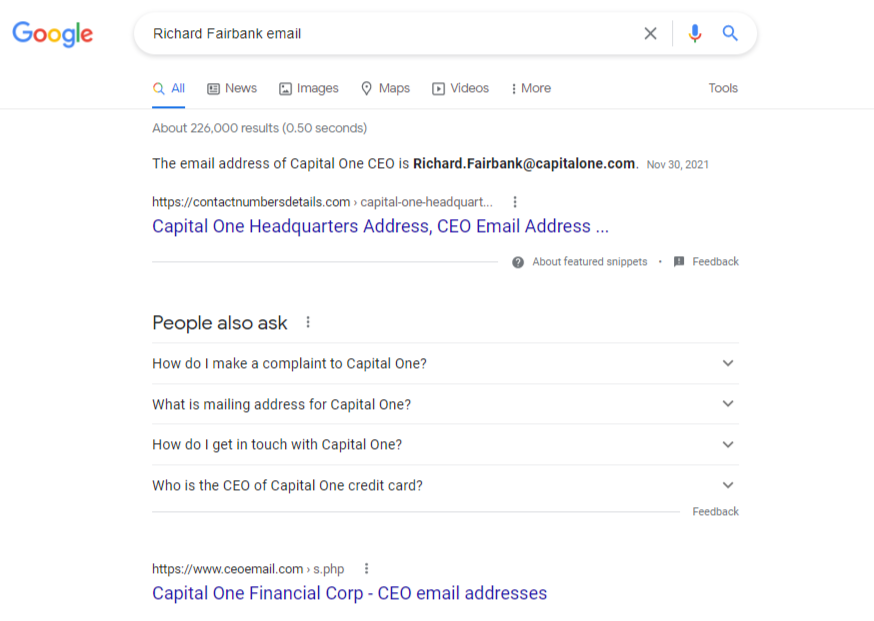

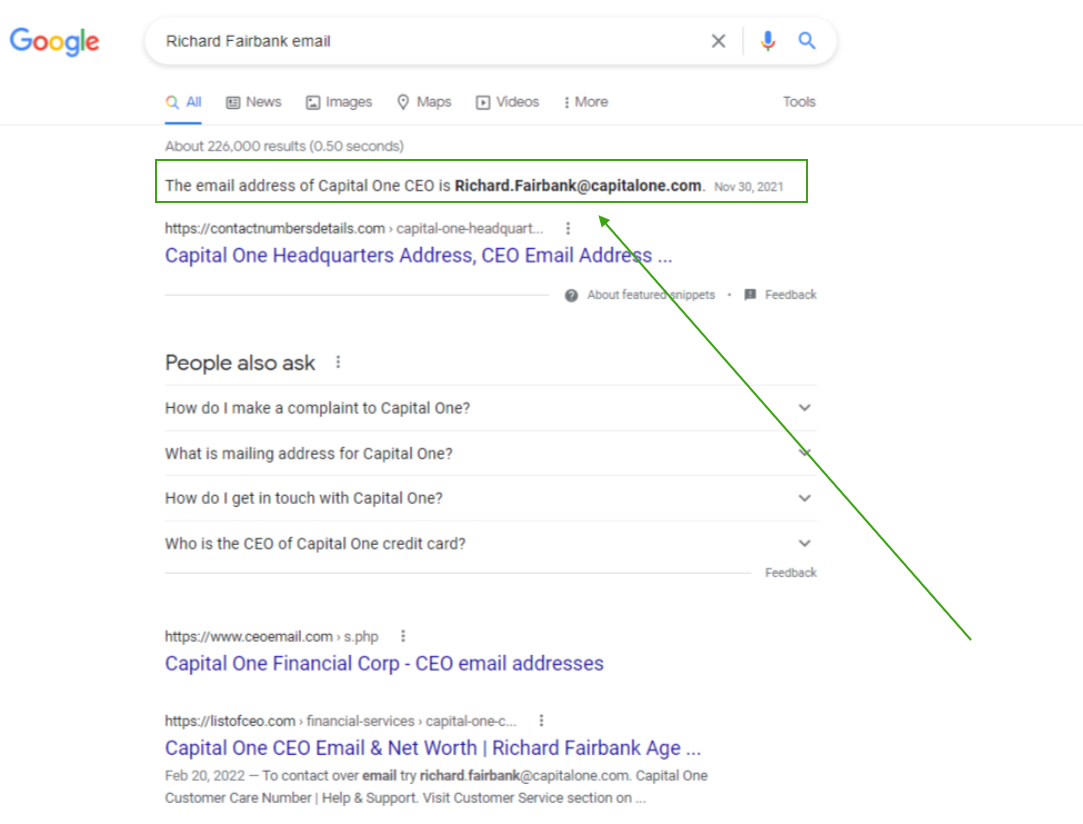

Step #2- Google their Name to find their Email

In some cases, you might get lucky finding their Email address by simply doing a Google Search like this:

In some small cases, you could even find their Email address in the search results like this:

If this is the Case, move onto step 3 and then skip all the final steps...

If no email was found, then move on to the next step:

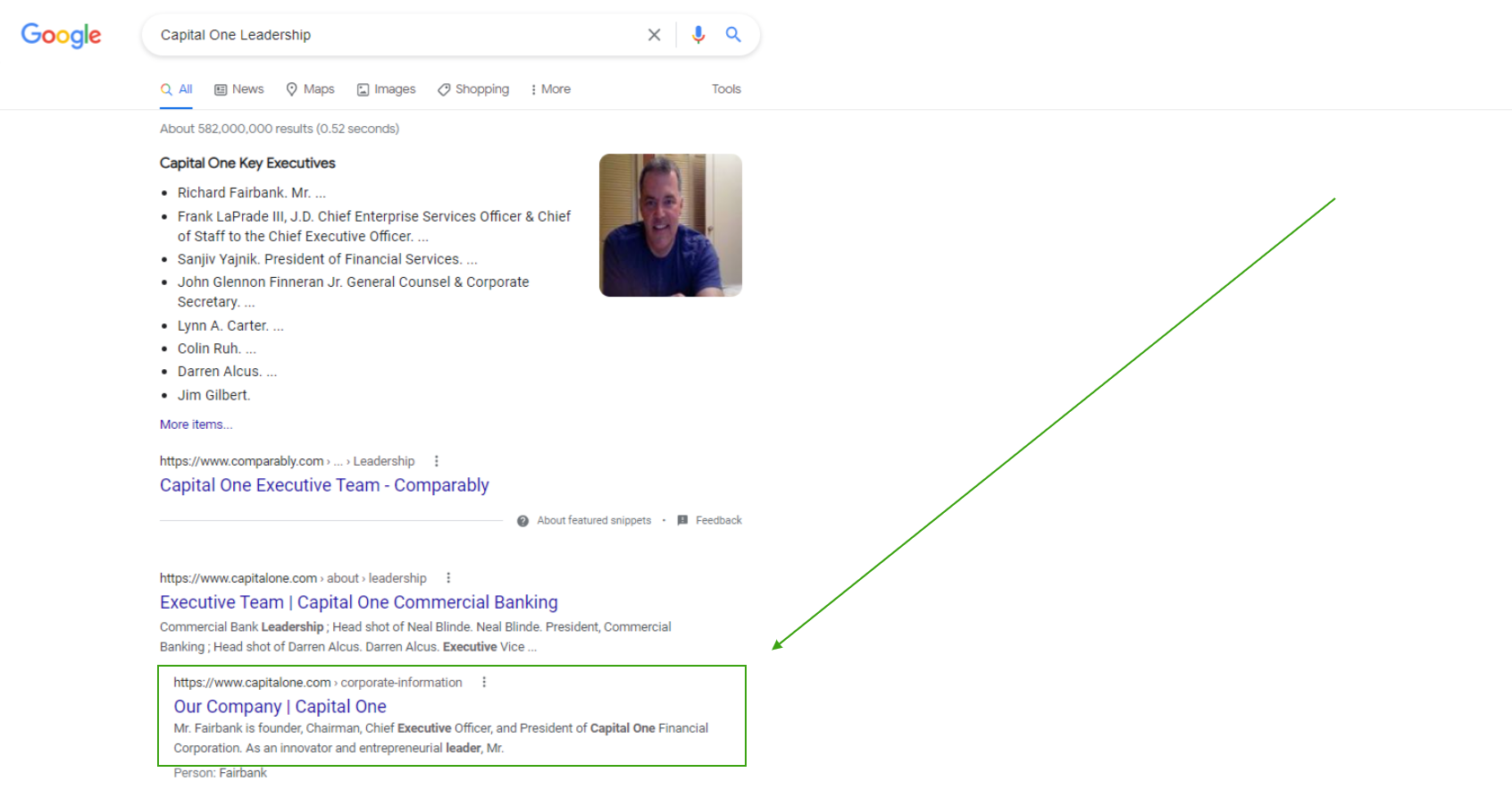

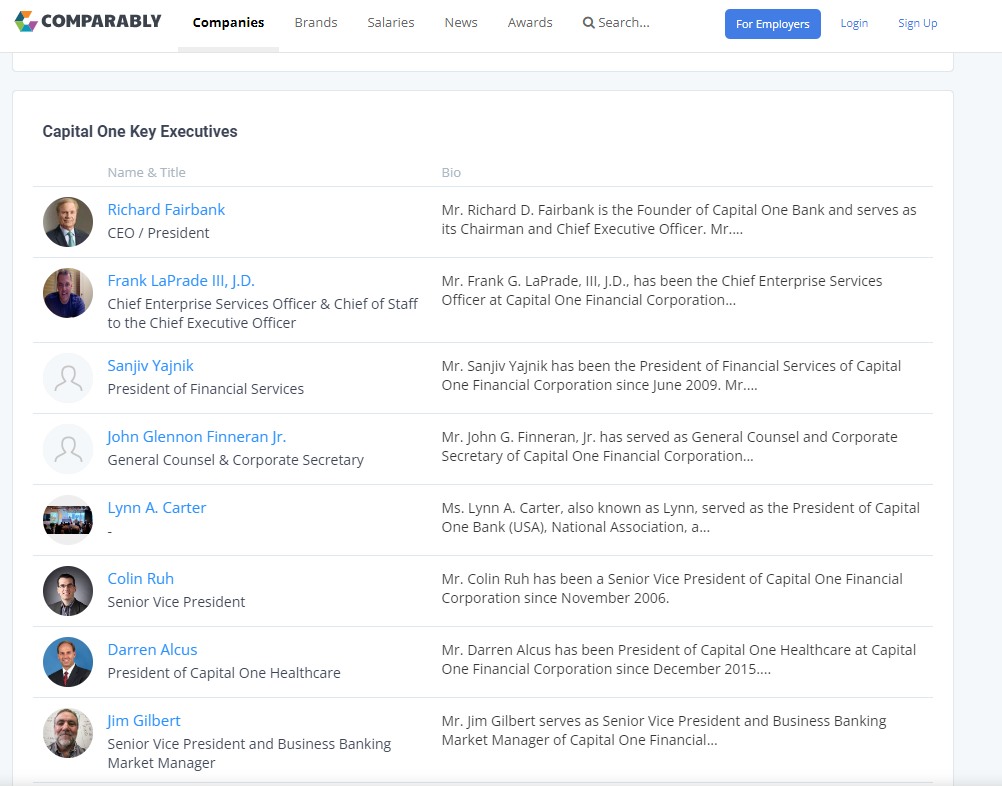

Step #3- Find others in the leadership staff

It doesn't hurt to find other Emails from other members on the Leadership Staff to include on the Email. Not all companies have a Leadership page or a list of their Leaders, it's always worth it to try...

Google Search the Company Name and the word "Leadership".

We'll use Capital One as an example again...

Now you may find a profusion of different websites that publish this information, but I recommend trying to find out if they have a page like this on their Website first. You want to ensure you're getting the most up-to-date information. In the case that their website doesn't provide the info you're looking for, you can rely on sites like this one.

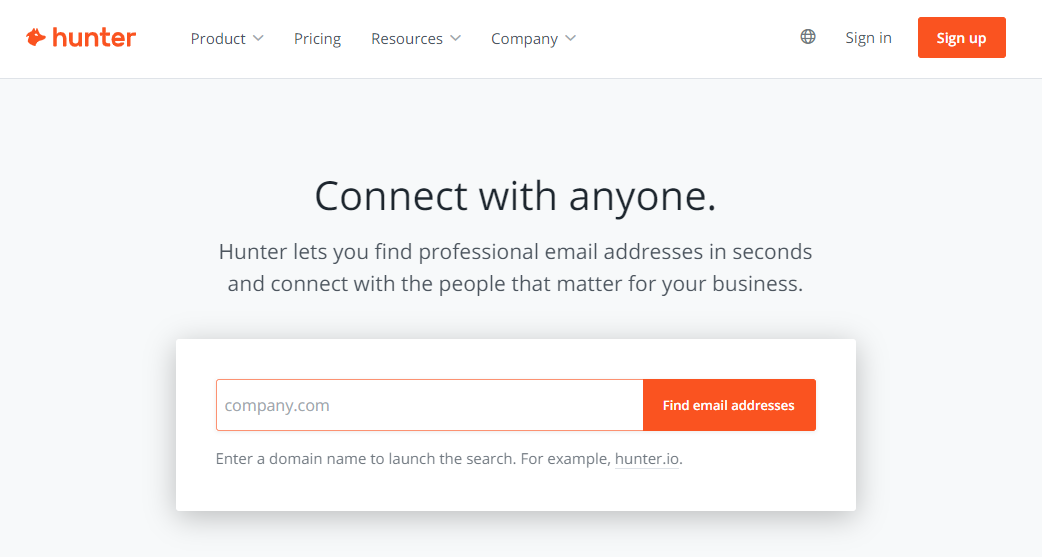

Step #4- Find Emails if not found on Google

Most companies will rarely post their Company Emails on their website and, in many cases, they are very hard to find online too. This is by design. It may take some investigation skills to find them. There are numerous websites that provide this information and most will charge you. A site that I have found to be free and very useful in this process is www.hunter.io

Go to www.hunter.io

Now under "Product" click on "Email Finder".

Type in any of the Leaders names that you were not able to find their name using a Google Search..

And click Search...

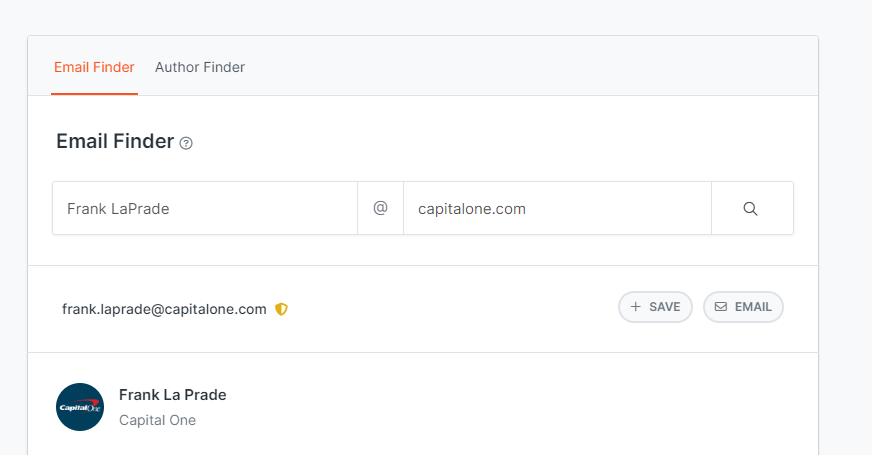

Once you click Search, if the program can find the email address, it will provide it to you like this...

You will "rinse and repeat" until you get 3-10 leadership email addresses. The more the better, but I wouldn't exceed 10 emails. Too many emails can come off as "spammy" or could cause the email to never even be delivered.

Also, Hunter.io only allows you to obtain 10 emails on their free trial. If you need to do this frequently and will exceed the 10 emails, you will have to join their paid version.

Step #5- Draft a Winning Email!

The final step is to draft up an Email that gets you Results! You want to make sure you put the CEO, President, or VP's email in the "To:'' field and all the other emails in the "CC:" field. The subject line needs to be catchy enough to grab their attention.

Here are a few memorable ones I've used, but definitely try to create your own: "Concerned"

"I am a current client and need your help" "Need help with my Account"

"Trying to resolve a concern"

"Hoping you can help"

Next, you want to put together an email that grabs their attention. PLEASE do not copy the example below as it has been used before. Copying it runs the risk of it being flagged as spam if the same letter has been sent to the same Creditor. Use this example as a reference to create your own unique email.

Here's how the email should flow...

<Insert Proof Dispute or Forgiveness Dispute Paragraph from section above>

Here is the referenced Account Information: <Creditor Account Name>

<Creditor Account Number>

I appreciate you taking the time to read my email. I look forward to your response.

Thanks,

<Your Name>

<Your Address> <Your Dob>

<Last 4 of Social Security Number>

<Phone Number>

Here is an example of what the email would look like put together:

Hi Richard,

My Name is John Smith and I am a customer of Capital One and have been for over 4 Years. I recently noticed your company has been reporting me late which has left me devastated and feeling beyond overwhelmed. My family has worked so hard to always make our payments on time, but with my husband and I recently losing our jobs and trying to support a family of 4, we have been in survival mode. We have recently gotten back on our feet after 2 years, and because of this I am seeing if I can request one really big favor.

Paying my bills on time has always been a priority and something that has been ingrained in me from such an early age. I know that this late payment will affect me from doing a lot to provide for my family and I wanted to see if you could please help me out by removing the late payment off my credit report. I promise this will be the ONLY request you will ever see from me and I promise to always keep my account in a positive standing moving forward.

I really appreciate you taking the time away from your busy day to read this and I really hope you're able to help me, this will mean the world to me.

Here is the referenced Account Information: Capital One

Account Number: 158562XXX

I appreciate you taking the time to read my email. I look forward to your response.

Thanks,

John Smith

1234 Papertrail Ave Houston, TX 85425

DOB: 01/01/1980 Last 4 of SS: 8452 Phone: 812-545-6533

Step #6- Wait for a Response

The best thing about this Method is it's usually pretty quick! Most of the times the Creditor will call you within 72 hours or they will at least respond back to your email within 24 Hours.

Either way, you should receive a pretty quick response. It's rare that the actual CEO, President, or VP will personally call or email you. Instead, it will usually be someone on their Executive Team. Keep in mind no worthwhile Company wants to have a valued client (YOU!) to have continual concerns that didn't get resolved and telling their family and friends about the experience. In most cases, they are just trying to resolve them as efficiently as possible, so always be polite.

Final Thoughts:

Credit Repair, in a general sense, can require a LOT of patience. Being UNIQUE and DIFFERENT will always outweigh the Traditional Processes you find online. If you can perfect this process, you can help thousands of people accomplish their dreams...

If you are like me (in the beginning) and just not able to sit long enough to do a process like this, feel free to HIRE THE PROFESSIONALS to do all the hard workon your behalf!