Blog

Updated on Jan. 08, 2026

Real Reasons Collections Stay After Credit Disputes

Most collections stay on credit reports after disputes for one simple reason: the account was verified as accurate by the creditor or collection agency, even if the information feels unfair or damagin...

Updated on Jan. 06, 2026

Credit Repair vs Debt Settlement: Which Helps Collections More?

When it comes to collections, credit repair helps more than debt settlement because it focuses on correcting, disputing, or removing how collections are reported, while debt settlement only addresses ...

Updated on Jan. 06, 2026

Does a Debt Lawsuit Impact Credit Scores?

The lawsuit itself doesn't appear on your credit report. But what happens because of the lawsuit absolutely does, and the damage can be severe.Here's what actually affects your credit score when you'r...

Updated on Jan. 06, 2026

Paid vs Unpaid Collections: Which Are Easier to Remove?

When it comes to removing collections from your credit report, unpaid collections are often easier to remove than paid ones, because once a collection is paid, the account is usually marked as verifie...

Updated on Jan. 03, 2026

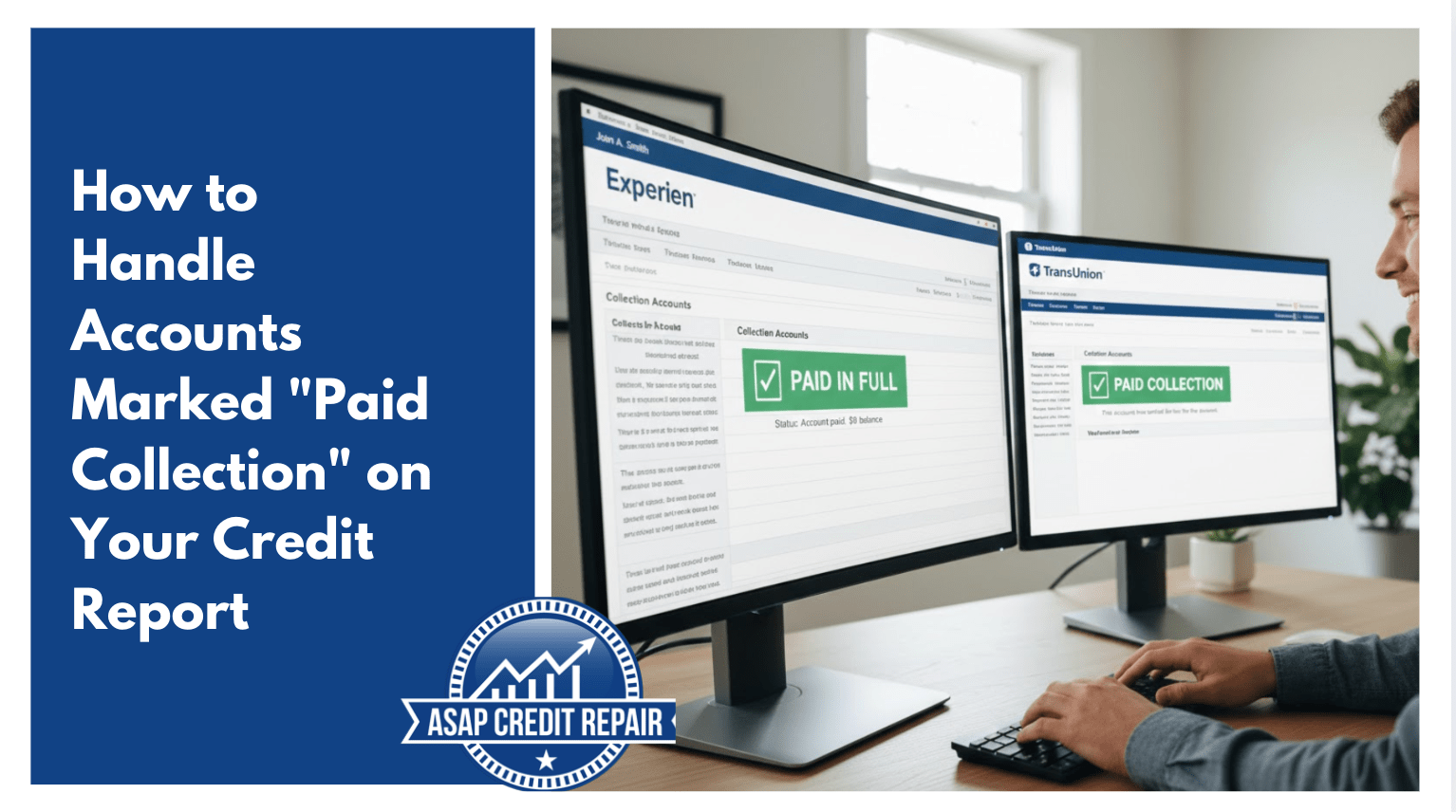

How to Handle Accounts Marked "Paid Collection" on Your Credit Report

A paid collection doesn't disappear just because you paid it.That's the part most people don't understand. They settle the debt, send the payment, and assume their credit report will reflect that the ...

Updated on Jan. 03, 2026

Why Some Credit Disputes Fail (And How to Fix Them)

Most credit disputes fail because they're generic.The bureaus receive millions of disputes every year. And when your dispute looks like everyone else's, it gets processed like everyone else's, with a ...

Updated on Jan. 03, 2026

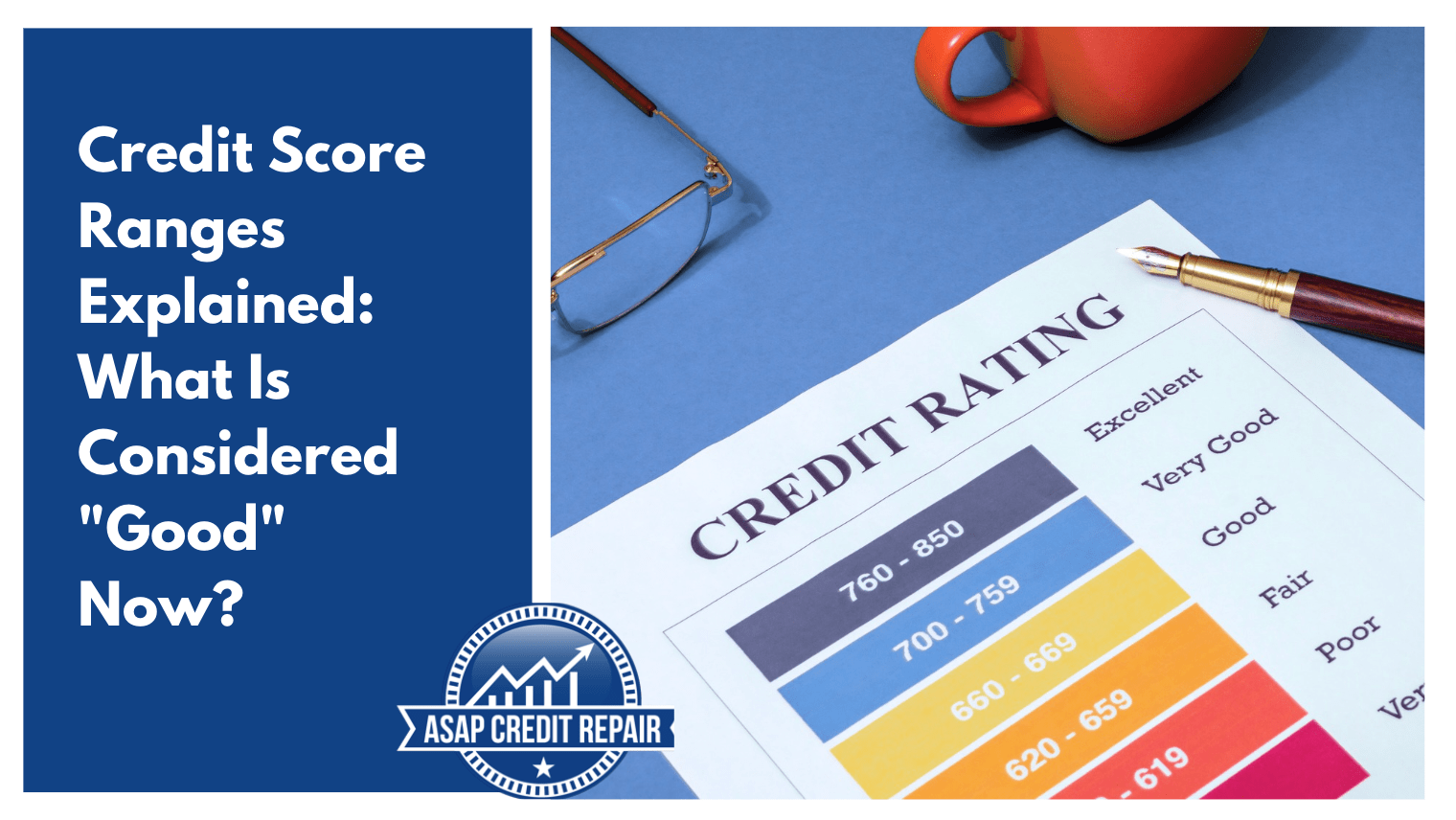

Credit Score Ranges Explained: What Is Considered "Good" Now?

The definition of a "good" credit score has shifted.Not because the ranges changed, they didn't. But because lenders are applying those ranges differently than they did five years ago.I've been runnin...

Updated on Jan. 03, 2026

What Really Impacts Your Credit Score in 2026

What Really Impacts Your Credit Score in 2026Your credit score isn't a mystery.It's a weighted calculation built on five specific factors: payment history (35%), credit utilization (30%), length of cr...

Updated on Dec. 30, 2025

How Fast Can I Delete a Negative Collection Item From Credit Report

How Fast Can I Delete a Negative Collection Item From Credit ReportA negative collection item can seriously damage your credit score, but the good news is that it may not have to stay there for years....

Updated on Dec. 30, 2025

How Fast Can You Increase a 400 Credit Score? Expert Answer

How Fast Can I Increase a 400 Credit Score?Table of ContentsWhy credit repair timelines exist before you take actionThe 30-60-90 day framework that actually moves scoresActions that compound versus ac...

Updated on Dec. 30, 2025

Who is Acme Credit Service and Why are They Calling

Effectively Handling Acme Credit Service CallsTable of ContentsUnderstanding Acme Credit Service before panic sets inWhy collection calls happen before formal notices arriveWhat Acme Credit Service ac...

Updated on Dec. 24, 2025

Why Deleted Credit Accounts Return (and How the FCRA Protects You)

Why deleted credit accounts return and reappearing on my credit report? That’s a common question we get daily. Frustration and fear shows everythis happens.As experts in credit law and reporting, we...

Updated on Dec. 24, 2025

Should You Consider Credit Card Debt Relief Next Year?

As the owner of ASAP Credit Repair, I need to be honest with you about something experts aren't saying loudly enough: credit card debt relief programs often create MORE credit damage than the debt its...

Updated on Dec. 23, 2025

How to Do a Credit Report Clean Up (Step-by-Step)

Credit report clean up involves three main steps: pulling your credit reports from all three bureaus, identifying errors or negative items, and disputing inaccurate information through formal processe...

Updated on Dec. 21, 2025

How Fast Can I Increase a 450 Credit Score?

A 450 credit score can increase to 580-600 (Fair range) in 3-6 months with aggressive action, or reach 650-700 (Good range) in 12-24 months with consistent positive habits. How Fast Can You Improve...

Updated on Dec. 18, 2025

Can Credit Unions Take Your House For Unpaid Loans?

Yes, credit unions can foreclose on your house if you default on a mortgage or home equity loan. But here's the shocking part: some credit unions can also take your house for unpaid credit card debt o...

Updated on Dec. 18, 2025

Student Loan SAVE Plan Ending: What It Means For You

The SAVE student loan repayment plan is ending. On December 9, 2025, the Department of Education announced a settlement agreement with Missouri that terminates the program, affecting over 7 million bo...

Updated on Dec. 18, 2025

Mortgage Credit Score Requirements Are Changing: What You Need To Know

Major mortgage credit score requirements just changed in November 2025. Fannie Mae eliminated its 620 minimum credit score requirement, and lenders can now use alternative credit scoring models that c...